Article by Gareth Thomas National Assembly for Wales Research Service

The UK Government’s joint Spending Review and Autumn Statement 2015 was published on 25 November 2015. This article sets out the main impacts on Wales ahead of the Plenary debate on 2 December and the publication of the Welsh Government’s Draft Budget 2016-17 on 8 December. What impact will the Spending Review have on the Welsh Government’s budget? Jane Hutt AM, Welsh Government Minister for Finance, has stated that this represents a 3.6% real terms reduction to the Departmental Expenditure Limit (DEL) element of the Welsh Government’s budget between 2015-16 and 2019-20 – the part of the budget it has discretion over how to spend. Within the overall budget over this period, the Welsh Government has stated that:

- There will be a 4.5% real terms reduction to Resource excluding depreciation;

- However Capital (infrastructure spending on fixed assets such as buildings) increases by 4.7% in real terms.

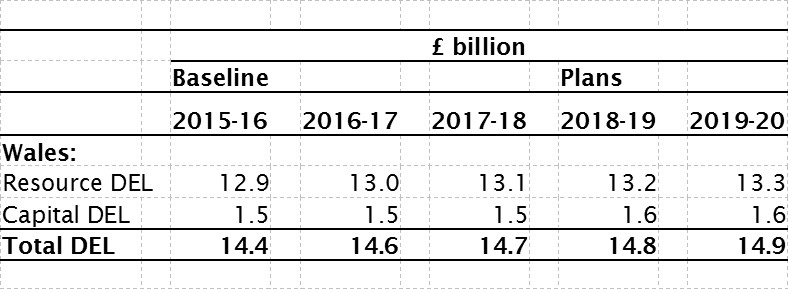

The table below sets out allocations to the Welsh Government’s block grant from 2015-16 to 2019-20. However, this assumes that the £46 million reductions from the Summer Budget 2015-16 will be deferred by the Welsh Government until 2016-17. A decision on this has not been reached yet. [caption id="attachment_5116" align="alignnone" width="682"] Source: HM Treasury, Spending Review and Autumn statement 2015[/caption] In addition to the block grant allocation to the Welsh Government, it can spend almost £1 billion in Welsh business rates receipts. Which measures in the Spending Review and Autumn Statement will directly affect Wales? A number of specific measures were announced directly relating to Wales and these are summarised below:

Source: HM Treasury, Spending Review and Autumn statement 2015[/caption] In addition to the block grant allocation to the Welsh Government, it can spend almost £1 billion in Welsh business rates receipts. Which measures in the Spending Review and Autumn Statement will directly affect Wales? A number of specific measures were announced directly relating to Wales and these are summarised below:

- A ‘funding floor’ where the Welsh Government will receive funding of at least 115% of comparable spending per head in England for this Parliament. We await the publication of further details on how this will operate in practice;

- The UK Government will legislate to remove the need for a referendum to introduce Welsh Rates of Income Tax, and we await the timetable for when this will happen;

- The UK Government has agreed in principle to support a new infrastructure fund for the Cardiff Capital Region (the Cardiff City Deal), subject to receiving firm proposals from Cardiff Council and the Welsh Government;

- The electrification of the Great Western Mainline will go ahead, however a Network Rail report notes that electrification from Cardiff to Swansea may be delayed; and

- The new prison in Wrexham will receive investment of £212 million;

A number of announcements on non-devolved areas will impact upon Wales including changes to the planned tax credit reductions, and changes to Housing Benefit and Pension Credit. Overall police funding in England and Wales will be protected in real terms until 2019-20, however the overall funding that goes to individual police forces will remain the same in cash terms. Not mentioned in the Spending Review

- The Welsh Government states that it has been assured that investment in High Speed 2 will result in additional funding for Wales in the future;

- S4C has stated that the funding it receives from the UK Government will be reduced from £6.7 million in 2015-16 to £5 million in 2019-20; and

- No update on the Swansea Bay tidal lagoon, or the devolution of Air Passenger Duty;

How will the work of the National Assembly for Wales follow on from this? On 8 December the Welsh Government publishes its Draft Budget 2016-17. This will propose spending plans for areas such as health, social care, local government and education. These spending proposals will then be scrutinised by the Assembly in the new year. The Finance Committee takes a strategic, overarching look at the budget, while the other Assembly Committees consider spending plans for their subject areas more closely. We’re planning to follow up this article with some more analysis of the tax and welfare measures and changes announced, so look out for these in the near future!