The UK Government’s White Paper has provided the most detailed outline yet of what the UK Government wants the UK’s economic relationship with the EU to look like after Brexit. How would this new relationship impact on the Welsh economy? This is one of a series of blog posts that examines the Welsh dimension of the UK Government’s recent Future Relationship, and follows a post examining environmental protection.

What areas of the Welsh economy are susceptible to Brexit?

Cardiff University Business School has written a report for the Welsh Government looking at which important areas of the Welsh economy are likely to be impacted on by Brexit (Economic Prospects for Large and Medium Sized Firms in Wales). The research was conducted largely through the lens of the Welsh Anchor and Regionally Important Companies (“Anchor Companies” are international companies with a significant presence in Wales), and does not consider agriculture or fisheries.

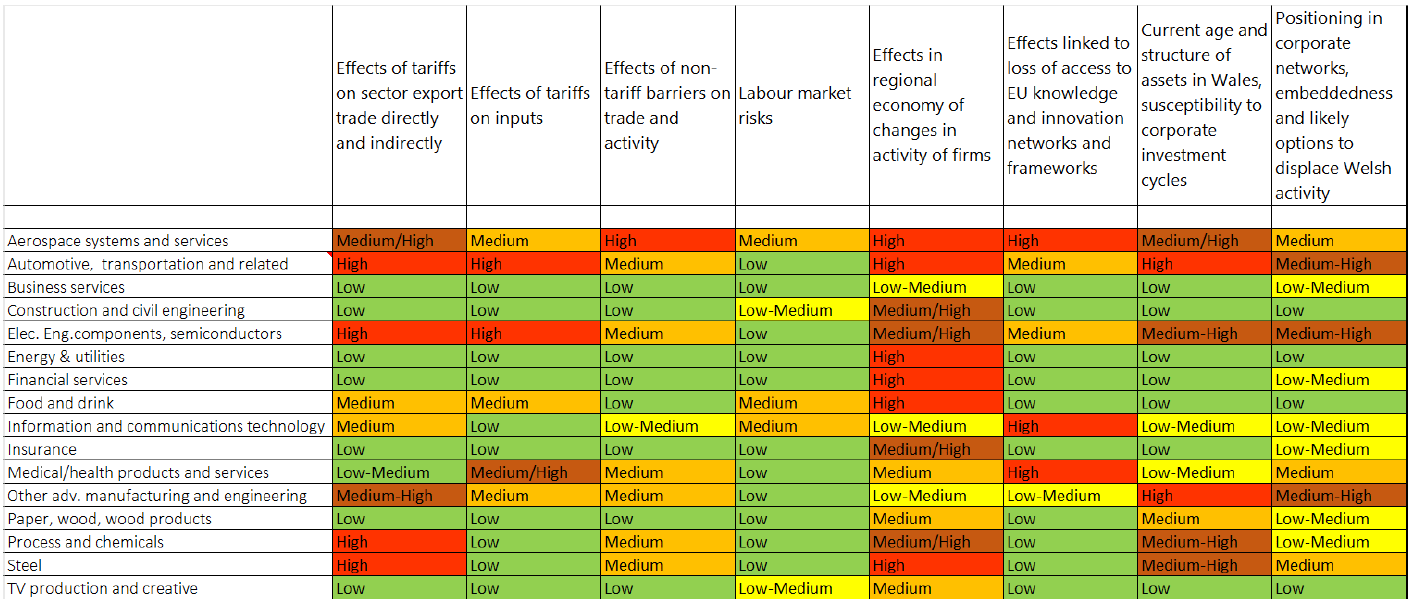

The Cardiff University report included the following table, summarising the risks associated with Brexit for different sectors in the Welsh economy:

Summary of how different sectors were rated on different aspects of risk  On 21 June 2018, aerospace company Airbus published a risk assessment highlighting its concerns about Brexit, especially if the UK were to leave the EU without a deal. These centred on the potential for changes to the Customs Union and Single Market rules which currently enable highly-integrated supply chains to operate across Europe, and possible restrictions to the free movement of Airbus staff. These concerns were the subject of a previous blog post.

On 21 June 2018, aerospace company Airbus published a risk assessment highlighting its concerns about Brexit, especially if the UK were to leave the EU without a deal. These centred on the potential for changes to the Customs Union and Single Market rules which currently enable highly-integrated supply chains to operate across Europe, and possible restrictions to the free movement of Airbus staff. These concerns were the subject of a previous blog post.

“Frictionless trade in goods”: maintaining the status quo

The UK Government has proposed establishing a “free trade area for goods”, which it feels would “protect the uniquely integrated supply chains and ‘just in time’ processes that have developed over the last 40 years”. This would be underpinned by:

- A “common rulebook” for goods (including agri-food) covering rules that are necessary to maintain frictionless trade between the UK and the EU.

- Participation by the UK in EU agencies that provide authorisation for goods in highly-regulated sectors: namely the European Chemicals Agency, the European Aviation Safety Agency, and the European Medicines Agency.

- No tariffs on any goods.

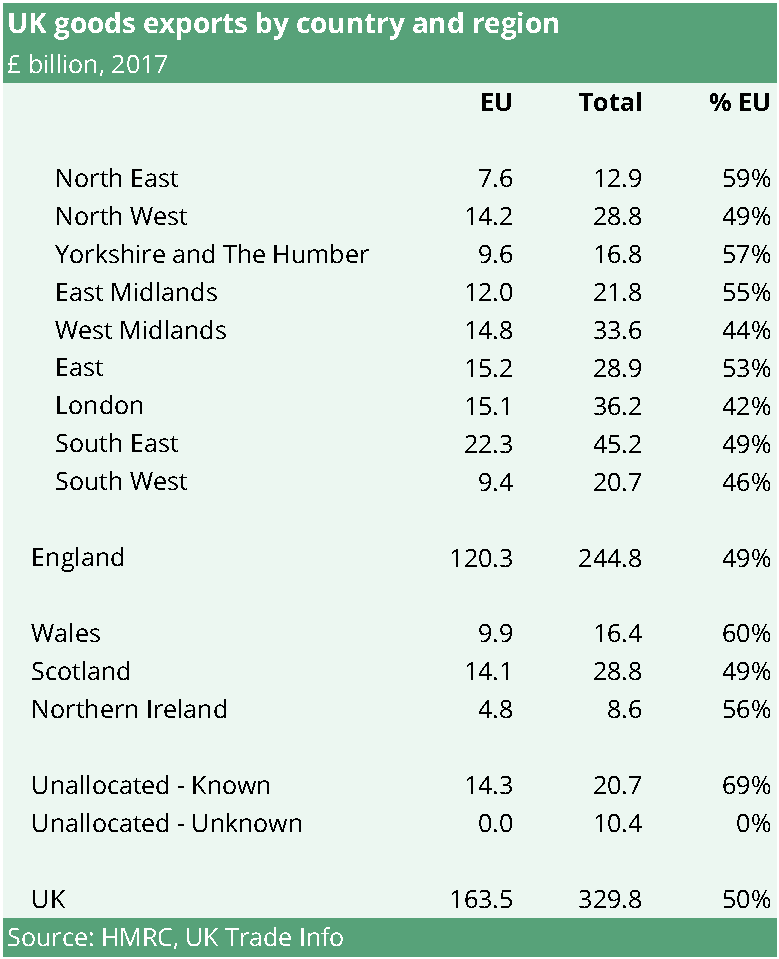

A greater proportion of Welsh exports go to the EU than those of any other country or region in the UK: UK goods exports by country and region  In 2017 60% of identifiable Welsh goods exports went to the EU, compared to 50% across the UK as a whole.

In 2017 60% of identifiable Welsh goods exports went to the EU, compared to 50% across the UK as a whole.

High value industries with a large presence in Wales – such as aerospace and automotive – are exposed to threats coming from Brexit, as they are highly-regulated and involve complex, cross-border supply chains. The White Paper proposals would seem to mitigate these threats, designed as they are to maintain the status-quo for trade in goods: zero tariffs and continued regulatory alignment between the UK and the EU in this area.

Airbus had raised concerns about the creation of barriers between the UK and the EU if the UK left the EU Customs Union. Although the UK intends to leave the Customs Union, the White Paper proposes a “Facilitated Customs Arrangement”, which would “remove the customs processes between the UK and the EU”. This a complex proposal. The White Paper acknowledges that several key areas would need to be discussed with the EU in order that the EU could be confident that goods cannot enter the EU market without paying the correct tariff.

New arrangements for services

The UK’s proposals for trade in services show a greater degree of deviation from the status quo than do those for trade in goods. The White Paper states:

The UK is proposing new arrangements for services and digital that would provide regulatory flexibility, which is important for the UK’s services-based economy. This means that the UK and the EU will not have current levels of access to each other’s markets.

Among the UK’s proposals are “a new economic and regulatory arrangement for financial services” and “mutual recognition of professional qualifications”.

Banks and financial services firms that are authorised in any EU or EEA state can trade freely in any other with minimal additional authorisation, through what are known as “passporting rights”. The White Paper acknowledges that, after Brexit, “the UK can no longer operate under the EU’s “passporting” regime, as this is intrinsic to the Single Market of which it will no longer be a member”.

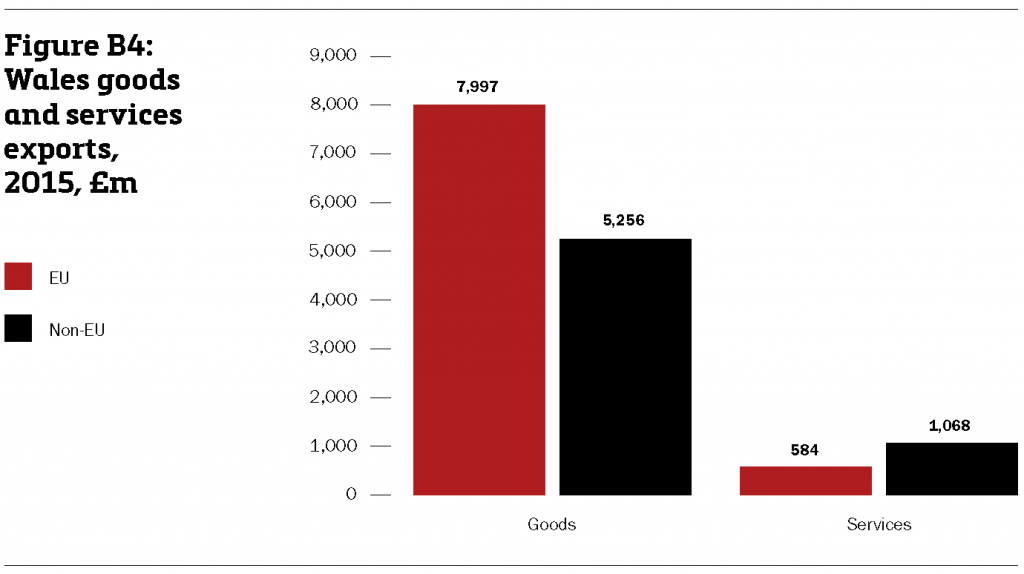

Wales exports a significantly greater value of goods to the EU than it does services:

Wales goods and services exports, 2015, £m

Whereas the majority of Welsh goods exports go to the EU (60% in 2015), around two thirds of Welsh service exports go to non-EU countries.

The UK financial services sector is a major export sector generating a large trade surplus for the UK. The financial services employs more than 1 million people, and accounted for 6.5% of the value created in the UK economy in 2017. Financial services in Wales are thought to be less externally focussed than they are in the UK as a whole. As economist Professor Gerald Holtham told the Assembly’s External Affairs Committee:

If the financial services sector in London catches a cold, I don’t think we’ll be very badly affected here. Most of our back offices are serving insurance companies with a domestic market, on the whole.

If UK/EU trade in financial services is damaged by the loss of passporting rights then Wales could expect to feel the consequences largely through reduced tax-yield at the UK Treasury, rather than directly in the Welsh economy.

What does the EU think?

The EU has repeatedly stated that the new UK/EU relationship cannot undermine the integrity of the Single Market. Although the most recent European Council negotiating guidelines endorse a “balanced, ambitious and wide-ranging free trade agreement”, it cautions that this “cannot amount to participation in the Single Market or parts thereof”. Whether the EU would accept the UK maintaining “frictionless trade” while rejecting freedom of movement, membership of the Customs Union and proposing new rules for services remains to be seen. As European Commission negotiator Michel Barnier saidfollowing his first meeting with the newly-appointed Secretary of State for Exiting the EU in July 2018:

Our challenge will be to find common ground between the fundamental principles that define the EU and the UK positions.

Article by Robin Wilkinson, National Assembly for Wales Research Service

Source: Cardiff University Business School, EU Transition and Economic Prospects for Large and Medium Sized Firms in Wales

Source: House of Commons Library: Statistics on UK-EU trade

Source: Welsh Government, Trade Policy: the issues for Wales