This blog post was updated on 14 June 2018 following the publication of a report by the Auditor General for Wales into the Welsh Government’s relationship with Pinewood.

The last decade has seen large growth in the film and TV production sector in Wales, and across the UK as a whole. Over this period the Welsh Government has invested in infrastructure – such as film and television studios - and in large media projects, on the provision that a large amount of their production costs are spent in Wales. This seems to have encouraged large production companies to shoot in Wales: but does the Welsh Government do enough to support Wales’s indigenous screen industry?

Large growth, from a low base

Since 2006, growth in the screen industries has been significantly faster in Wales than it has across the UK; albeit from a considerably lower base. However, the sector in Wales still forms far less than a population-based share of the sector in the UK as a whole.

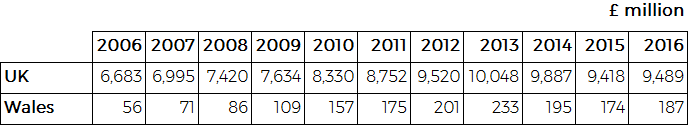

GVA of Motion picture, video and TV programme production in Wales and the UK

- Since 2006, GVA of motion picture, video and TV programme production in Wales has grown from £56 million to £187 million in 2016. This is an increase of 334%.

- In the UK as a whole, GVA in this area has grown from £6.7 billion in 2006 to £9.5 billion in 2016. This is an increase of 42%.

- Between 2006 and 2016, Welsh GVA in this area has grown from 0.8% of the UK total to 1.8% of the UK total.

Welsh Government investments

The Welsh Government’s £30 million Media Investment Budget provides commercial funding (loans and grants) for media productions, conditional on shooting and spending in Wales. As of November 2017, the Government had invested £12 million in film and TV projects through the Media Investment Budget, and recouped £3.7 million. The Government has noted that not all of these projects have reached cinematic release, and it expects to continue getting a share of the profits for “at least another ten years”.

The Government has also sought to improve the infrastructure for making film and television in Wales by investing in studios. These include:

- Wolf Studios Wales: production company Bad Wolf’s studios in Cardiff have been acquired by the Welsh Government, and are leased on commercial terms to Bad Wolf.

- Pinewood Studio Wales: In 2015, the film company began a 15-year lease on a Welsh Government-owned warehouse in Cardiff. The terms were renegotiated, and a new Management Services Agreement entered into on 1 November 2017. The annual net cost to the Welsh Government of the Management Services Agreement is estimated to be £392,000 (plus an additional annual management fee to Pinewood). Welsh Government officials recognise that these financial projections do not represent good value for money. The Welsh Government’s relationship with Pinewood was the subject of a report by the Auditor General for Wales, published on 12 June

- Development of the Roath Lock studios where the BBC makes drama productions such as Dr Who, Casualty and Pobol y Cwm.

Production company Bad Wolf was itself formed in 2015 using a £4 million loan from the Welsh Government. Bad Wolf say that this public investment has helped to “establish an anchor, a production company and facilities of significant scale and world-class ambition and track record, which could help build a sustainable industry in Wales”. Bad Wolf says that in three years it has created 245 jobs, secured £13m in private investment into Wales, and secured future production budgets of £134m.

Is Welsh Government support too “commercially geared”?

Witnesses to the Culture, Welsh Language and Communications Committee’s inquiry into Film and Major Television Production have questioned whether the Welsh Government is doing enough to grow Wales’s indigenous screen industry. Ffilm Cymru – which is largely lottery funded and aims to develop the film sector in Wales - thinks that the “commercially geared” Media Investment Budget “is more naturally geared at large-scale and long-running productions and inward investments” rather than building Wales’ screen sector from the ground up.

Pauline Burt, Ffilm Cymru’s Chief Executive, did note that the Welsh Government has “had quite reasonable success in bringing inward investment to Wales and having a flow of opportunities for skills and employment.”

Roger Williams from Joio – one of the few Welsh companies to receive funding from the MIB, for bilingual crime drama BANG – described the process of applying for funding from the MIB as “incredibly frustrating”. The distributors and lawyers involved in the production, he said, had “never come across a more restrictive deal”. Severn Screen’s Ed Talfan – producer of bilingual crime drama Hinterland/Y Gwyll – said that the terms of the MIB were too “onerous” for other parties involved in financing his production, so he had been put off applying.

The Committee has heard a number of suggestions as to how the Welsh Government should better support the local industry. Wales-based production companies Truth Department and ie ie productions called for the Welsh Government to provide funding for smaller productions than those that can currently apply to the MIB, based on their cultural as well as their economic value.

Others – such as Paul Higgins from Dragon DI and Ed Talfan from Severn Screen – raised the question as to whether a condition should be attached to MIB funding that large production companies in receipt of funding co-produced with smaller, local production companies. Actor Julian Lewis Jones and director Euros Lyn suggested that funding should be conditional on employing Wales-based cast or senior crew members. Performers’ union Equity thinks that production companies should be made to investigate local casting.

“Definitely not” enough expertise within the Welsh Government

These conversations are taking place at a time of flux in the Welsh Government’s economic development strategy. Its new economic plan, Prosperity for all, was published in December 2017. This sees the Welsh Government moving away from its previous “sectoral” approach, where it sought to grow nine priority sectors, one of which was the creative industries. Between 2006 and 2015 creative industries GVA grew by 23.4 per cent in Wales, compared to an average growth across all industries of 9.6 per cent.

Under the sectoral approach the Welsh Government received advice from a Creative Industries Sector Panel, led by Tinopolis founder and chair Ron Jones. Asked whether the Welsh Government would have enough in-house advice should this panel be scrapped, Bad Wolf’s Natasha Hale – who previous held a senior role in the Welsh Government’s creative industries team – said “definitely not”.

We don’t know what skills we don’t have

The Committee has heard – from witnesses including the BBC and Bad Wolf - that the biggest factor restricting growth in the screen industries in Wales is a potential skills shortage. Director of BBC Cymru Wales Rhodri Talfan Davies noted the scale of the opportunity: “Because of the growth in high-end television across the world, because of the emergence of new players like Amazon and Apple and Netflix, the demand for high-end television skills is at an unprecedented level”.

Natasha Hale warned the Committee, “if we keep growing too much without developing our talent and our skills, we will stop being able to deliver for the industry”. The scale of any skills shortage is unknown. Dr Ruth McElroy of University of South Wales explained that “one of the big problems is that we haven't got good baseline data”.

Global opportunity

All signs are that the massive surge in consumption of video content on electronic devices will continue to drive growth in the screen industries internationally. The Committee’s report will consider how the Welsh Government should best balance inward investment, indigenous growth and skills support to make sure that Wales makes the most of this global opportunity.

Article by Robin Wilkinson, National Assembly for Wales Research Service

Source: ONS, Nominal and real GVA by industry (2017)