Business rates revaluations have been a subject of interest across Britain over recent weeks and months, with concerns raised about the impact on businesses who will see their business rates rise from April 2017. Different approaches have been taken to address this across Wales, England and Scotland (Northern Ireland’s revaluation came into force in 2015).

This blog article updates our previous one, published in December 2016, which provided details of the revaluation and its impacts. The revaluation in Wales has been independently undertaken by the Valuation Office Agency (VOA), and the Welsh Government does not apply policy or guidance to the revaluation.

What impact has the revaluation had on different parts of Wales?

As the previous article explains, changes to rateable values are one component of the overall business rates bill, which is also affected by the business rates multiplier set by the Welsh Government every financial year, as well as any reliefs that businesses may be entitled to.

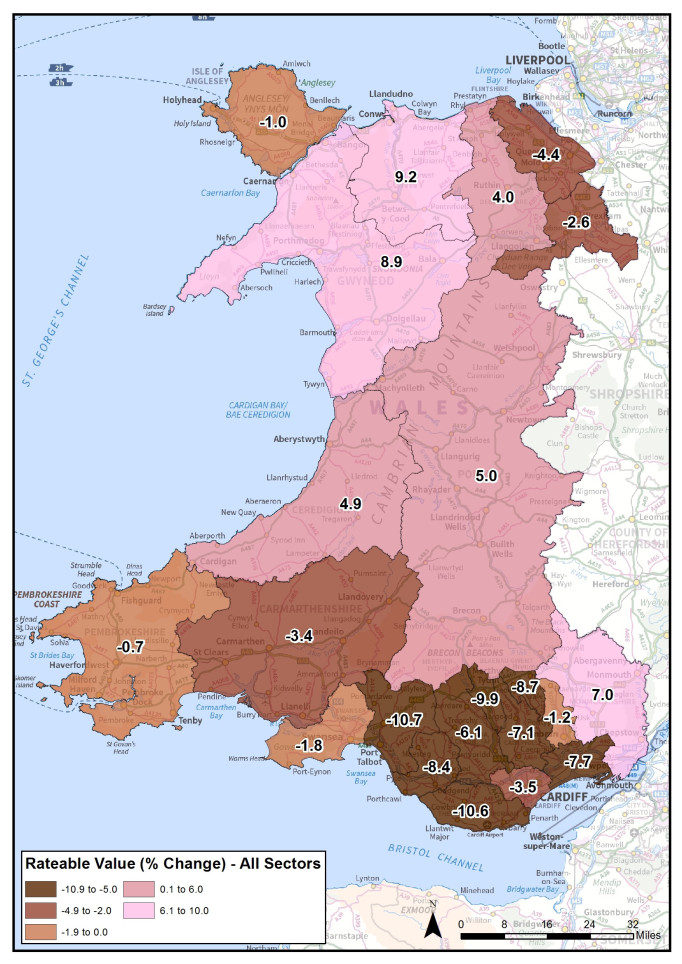

The areas that have seen the largest rises in rateable values between the 2010 valuation and the draft 2017 revaluation figures are predominantly rural areas, such as Conwy (9.2% average increase), Gwynedd (8.9% average increase) and Monmouthshire (7.0% average increase). These figures are different from the estimated impacts on bills in England that have been discussed in the media in recent days, as stated above rateable values are only one component of the calculation of business rates bills.

The VOA have published maps of the average percentage change in rateable value in each local authority, and these are set out below. When looking at these figures, it is important to note that this is an average across the area and sectors, so the impact on particular sectors and areas within local authority areas may be different. Some businesses in all local authority areas will have seen increases, while others will have seen decreases in their rateable value.

What measures has the Welsh Government put in place to help businesses whose bills will rise due to the revaluation?

The Welsh Government has introduced two measures that will provide transitional relief from April 2017 to businesses negatively affected by the revaluation.

The first scheme, announced in September 2016, is targeted at small businesses, and the Welsh Government will provide £10 million funding which will benefit 7,000 ratepayers. Businesses who currently have premises with a rateable value of up to £12,000 and are eligible for small business rate relief in 2016-17, but will receive either less or no relief in 2017-18 due to the rateable value of their property increasing will benefit from this scheme. The proposed transitional relief will spread increases in business rates liability over a three-year period, so businesses will pay 25% of their increased liability in 2017-18, 50% in 2018-19 and 75% in 2019-20. By the start of the 2020-21 ratepayers will pay their full bill based on the 2017 revaluation. Regulations introducing this scheme were discussed and passed through a vote in Plenary on 13 December 2016.

On 17 February, the Welsh Government set out details of a further transitional relief scheme, the High Street Rates Relief scheme. This is targeted at high street businesses such as shops, restaurants, cafes, pubs and wine bars. This scheme will also cost the Welsh Government £10 million, and will be introduced from April 2017, benefitting 15,000 businesses. The Cabinet Secretary’s written statement sets out the qualifying criteria for the scheme. Retailers can find out whether they are eligible for the scheme by contacting their local authority.

There are two tiers of relief under this scheme. Under the first tier, high street retailers with a rateable value of between £6,001 and £12,000 who are already receiving either small business rates relief (SBRR) or transitional rates relief will receive a reduction in their rates bill of £500 or, if their bill is less than £500, it will be reduced to nil. Under the second tier, eligible high street retailers with a rateable value of between £12,001 and £50,000 which are experiencing a rates increase from April 1 will receive a reduction in their bill of £1,500.

How does this differ from what is being proposed elsewhere in Britain?

Both England and Scotland have stated that they will implement different approaches to mitigating the negative impact of the revaluation on some businesses.

Under the UK Government’s scheme for England, it is proposed that all businesses who see an increase in their business rates bill as a result of the revaluation will receive some transitional relief. A key difference to the scheme in Wales is that this is a self-financing scheme, which is paid for by capping the reductions that businesses who see a decrease in their bills will receive. Small and medium businesses receive greater support than larger businesses. The UK Government Secretary of State for Communities and Local Government announced on 22 February that he is working closely with the Chancellor of the Exchequer to provide further support to businesses in England facing the largest bill increases, with an announcement expected at the UK Government budget on 8 March.

In Scotland, the Scottish Government has capped bill increases at 12.5% for hospitality businesses such as hotels and pubs, and also offices in Aberdeen and Aberdeenshire. The hospitality and pub sectors have raised concerns about the scale of increases they will face, and also the different valuation methodology used in these sectors. The cap on offices in Aberdeen and Aberdeenshire is due to the impact of the fall in oil prices on the local economy.

Article by Gareth Thomas, National Assembly for Wales Research Service

This post is also available as a print-friendly PDF: The business rates revaluation and transitional relief: An update (PDF, 298KB)