Article by Christian Tipples and David Millett, National Assembly for Wales Research Service

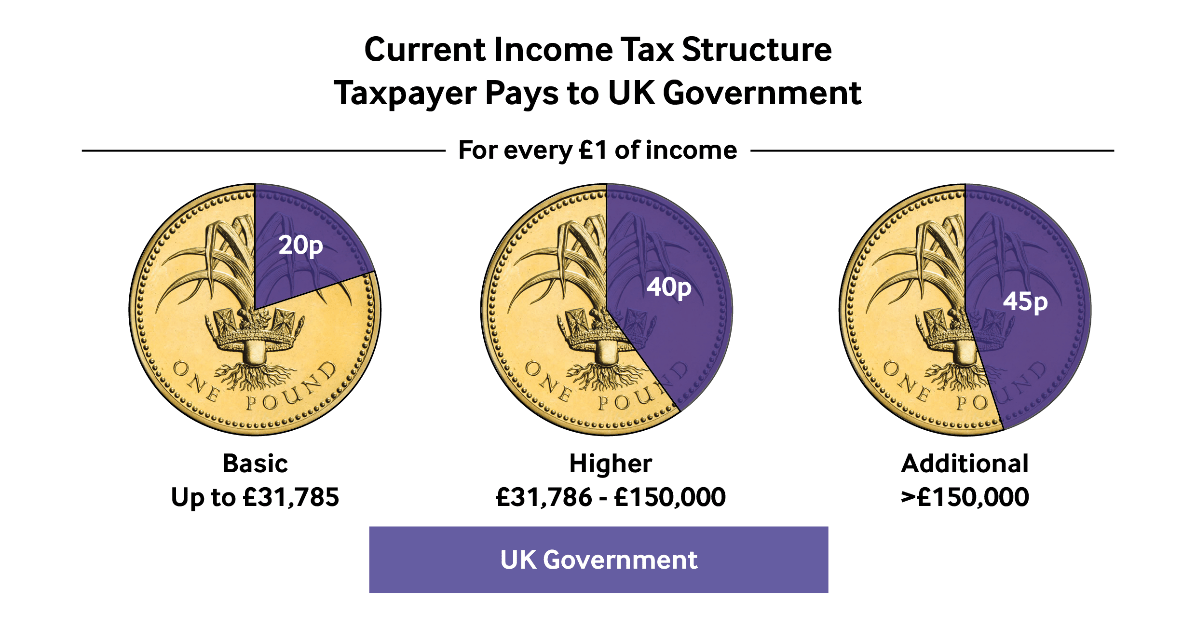

On 25 November 2015, the Chancellor, George Osborne, announced the much anticipated joint Spending Review and Autumn Statement. During his statement, he made an unexpected announcement about income tax being partly devolved to Wales without the need for a referendum. What is income tax? Income tax is something you pay on your income like wages and most pensions. It is split into three different rates and is currently paid to the UK Government:

- Basic Rate

- Higher Rate

- Additional Rate

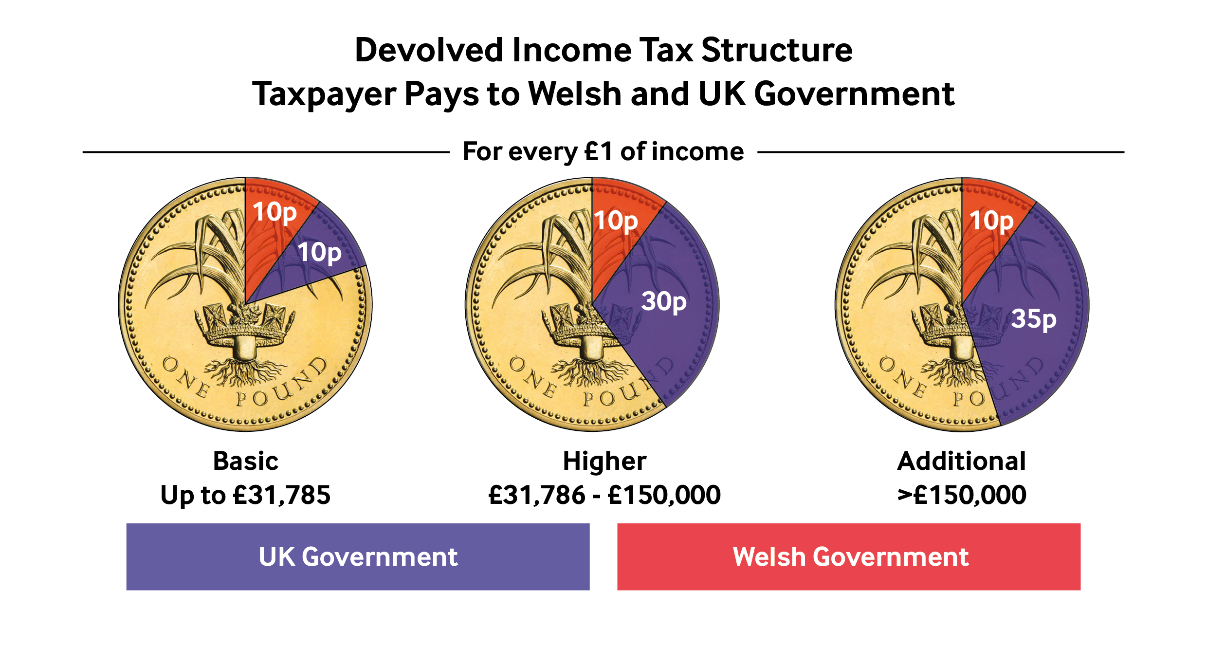

What the taxpayer has to pay once the personal allowance is taken into account is illustrated below.  How can income tax be partly devolved? For each income tax rate, the Welsh Government will be responsible for collecting 10p whilst the UK government collects the remainder as explained below.

How can income tax be partly devolved? For each income tax rate, the Welsh Government will be responsible for collecting 10p whilst the UK government collects the remainder as explained below.  The Office for Budget Responsibility (OBR) forecast that Welsh Government would collect £2bn from Welsh taxpayers to help fund public services in Wales. Why did Wales need a referendum? The Wales Act 2014 required Welsh Government to hold a referendum to determine whether the people of Wales supported the devolution of income tax powers. During the Spending Review and Autumn Statement, the UK Government announced it was reversing this decision with Stephen Crabb, the Secretary of State for Wales, tweeting "I will amend (the) Wales Bill to remove (the) referendum block on Welsh tax powers. Wales needs a more accountable & effective Assembly." Discussions will need to take place to determine if there will simply be a transfer of powers or whether the Assembly will need to vote on the matter. What does this mean for Welsh taxpayers? To answer this, we have to look at both the short and long-term implications. Short-Term The Welsh taxpayer will not be affected in the short-term. Detailed discussions will need to take place between the UK and Welsh Governments about how income tax powers will be devolved to Wales. This will most likely be a lengthy process given the complex issues that will need to be addressed. Long-Term If income tax is partially devolved to Wales, then the Welsh Government will have the ability to raise or lower income tax rates. It has been estimated that if the Government raised or lowered the basic rate of income tax by 1p then this would result in an increase or reduction of around £165m – £180m in funding for Wales although behavioural changes may reduce this impact slightly. It is too early to predict what the Government will do if income tax powers are devolved and how it will affect taxpayers but there would potentially be a range of benefits to Wales such as:

The Office for Budget Responsibility (OBR) forecast that Welsh Government would collect £2bn from Welsh taxpayers to help fund public services in Wales. Why did Wales need a referendum? The Wales Act 2014 required Welsh Government to hold a referendum to determine whether the people of Wales supported the devolution of income tax powers. During the Spending Review and Autumn Statement, the UK Government announced it was reversing this decision with Stephen Crabb, the Secretary of State for Wales, tweeting "I will amend (the) Wales Bill to remove (the) referendum block on Welsh tax powers. Wales needs a more accountable & effective Assembly." Discussions will need to take place to determine if there will simply be a transfer of powers or whether the Assembly will need to vote on the matter. What does this mean for Welsh taxpayers? To answer this, we have to look at both the short and long-term implications. Short-Term The Welsh taxpayer will not be affected in the short-term. Detailed discussions will need to take place between the UK and Welsh Governments about how income tax powers will be devolved to Wales. This will most likely be a lengthy process given the complex issues that will need to be addressed. Long-Term If income tax is partially devolved to Wales, then the Welsh Government will have the ability to raise or lower income tax rates. It has been estimated that if the Government raised or lowered the basic rate of income tax by 1p then this would result in an increase or reduction of around £165m – £180m in funding for Wales although behavioural changes may reduce this impact slightly. It is too early to predict what the Government will do if income tax powers are devolved and how it will affect taxpayers but there would potentially be a range of benefits to Wales such as:

- Improve financial accountability of Welsh Government

- Offer the Government more control over its own budget

- Give Wales the chance to introduce more progressive tax policies to support areas such as economic development

This is not to say there aren’t risks to devolving income tax powers. An article published by the Bevan Foundation discusses these in more detail.