21 October 2013

Article by Richard Bettley, National Assembly for Wales Research Service

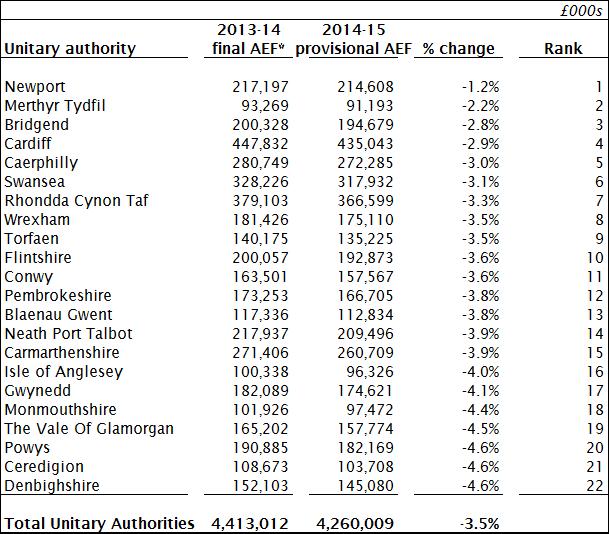

On 16th October the Minister for Local Government and Government Business published proposals for the funding of Local Government in Wales for 2014-15. This note summarises briefly some of the key points, and table 1 shows the breakdown by authority. The Welsh Government has also published further details. 1. Revenue Settlement Overall 2014-15: £4.26 billion which is a decrease of 3.5%, £153 million. Reductions range from: a 1.2% cut in Newport and a 4.6% cut in Denbighshire, Ceredigion and Powys. Indicative allocations for 2015-16 show further reductions of 1.55%. Additions to Settlement:

- Includes 1% protection for schools, £16 million.

- Includes £244 million for the council tax reduction scheme. The Minister has commissioned a review into a longer-term sustainable and equitable scheme to be in place for 2015-16, within the available funding for that year.

Transfers into the Settlement

- Transfer in of £39.3 million specific grant funding

- De-hypothecate over £30 million previously identified for Private Finance Initiative and the Public Facilities Grant. (£145 million has been transferred into the Revenue Support Grant (RSG) this Assembly).

- Transfer into the settlement, an additional £3.2 million in relation to the First Steps Improvement Package and £5.2 million for the administration of Council Tax Reduction Schemes.

It was announced that the Minister is commissioning a review, in partnership with Local Government, of the remaining specific grants.

- Included in the settlement is an additional £4 million to support the Local Government Borrowing Initiative for Highways Improvement.

Damping Damping threshold is for no authority to have a greater than 4.75% fall in allocations, when adjusted for transfers. As this excludes Local Authority Business Growth Incentives (LABGI) and Private Finance Initiative (PFI) funding, no authority will experience a reduction of over 4.6%. Council tax capping The Minister has made it very clear she is prepared to use capping powers in the event of excessive increases. 2. Capital funding The Provisional Local Government Capital Settlement for 2014-15 is £383 million. This is a reduction of £64 million or 14.4%. Table 1 – 2014-15 Provisional Settlement: comparison between the total funding for 2013-14 and 2014-15