15 October 2013

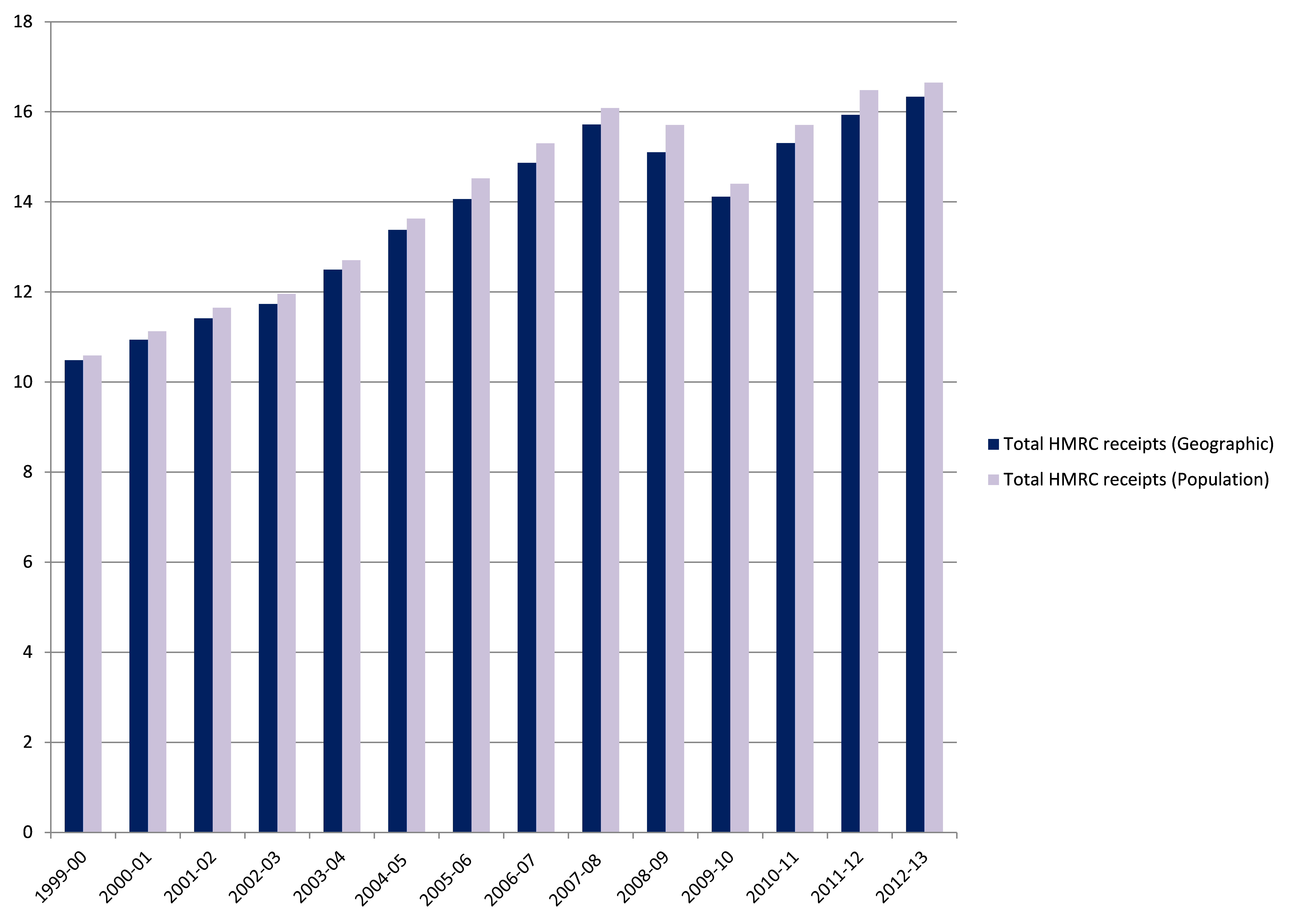

On 2 October 2013 HM Revenue and Customs (HMRC) published official experimental statistics showing A Disaggregation of HMRC Tax Receipts between England, Wales, Scotland and Northern Ireland. This is the first time that official statistics have been published for Wales, building on the estimates of Welsh tax receipts produced by the Holtham Commission and part 1 of the Silk Commission’s work covering fiscal powers. Statistics have been published using two methodologies to reflect uncertainties in allocating some taxes. The geographic methodology allocates revenue from offshore Corporation Tax and Petroleum Revenue Tax for North Sea gas and oil revenues to England and Scotland on a field by field basis. The population method allocates revenue from these two taxes according to the UK population share of each nation. This has little impact on HMRC tax receipts from Wales, England or Northern Ireland, however if receipts for these two taxes are allocated on a geographic basis then Scottish receipts increase. As a percentage of UK tax receipts the amount generated in Wales has remained at around 3.5% between 1999-2000 and 2012-13. In 2012-13, using both methodologies 3.5% of UK HMRC tax receipts were generated in Wales, which is actually slightly lower than the 3.6% generated in 1999-2000. In comparison, Office for National Statistics mid 2012 population estimates show that the population of Wales is 4.8% of the UK total. It can be observed from figure 1 that: • Total HMRC tax receipts in Wales have risen from £10.5 billion in 1999-2000 to £16.3 billion in 2012-13 if a geographic approach is taken to assigning receipts from offshore Corporation Tax and Petroleum Revenue Tax. • If a population-based approach is applied to the two taxes mentioned above, total HMRC tax receipts in Wales have risen from £10.6 billion in 1999-2000 to £16.7 billion in 2012-13. • Using both methodologies tax receipts generated in Wales declined from 2007-08 to 2009-10, before starting to increase again from 2010-11. This reflects the economic situation at the time. Figure 1: Welsh tax receipts using geographic and population based methodologies, 1999-2000 to 2012-13 (in £ billion)  Source: HM Revenue and Customs, A Disaggregation of HMRC Tax Receipts between England, Wales, Scotland and Northern Ireland: Statistics table Using both methods of assigning offshore Corporation Tax and Petroleum Revenue Tax, total Welsh HMRC tax receipts grew the least of the UK nations between 1999-2000 and 2012-13. If the geographic methodology is applied Scotland had the largest increase in total tax receipts over this period, while if the population-based methodology is applied Northern Ireland had the largest increase. HMRC have published estimates of Welsh tax receipts for individual taxes in 2012-13, and these receipts as a percentage of UK receipts. It can be seen that:

Source: HM Revenue and Customs, A Disaggregation of HMRC Tax Receipts between England, Wales, Scotland and Northern Ireland: Statistics table Using both methods of assigning offshore Corporation Tax and Petroleum Revenue Tax, total Welsh HMRC tax receipts grew the least of the UK nations between 1999-2000 and 2012-13. If the geographic methodology is applied Scotland had the largest increase in total tax receipts over this period, while if the population-based methodology is applied Northern Ireland had the largest increase. HMRC have published estimates of Welsh tax receipts for individual taxes in 2012-13, and these receipts as a percentage of UK receipts. It can be seen that:

- The taxes that generated the largest amount of receipts from Wales were income tax (£4.8 billion), VAT (£4.2 billion) and National Insurance Contributions (£3.7 billion).

- However, Welsh receipts from income tax made up 3.1% of UK receipts, with VAT and National Insurance Contributions comprising 4.1% and 3.6% of UK receipts respectively.

- The taxes where receipts from Wales contributed the greatest percentage of UK receipts were all taxes with relatively minor receipts; these were the Aggregates Levy (8.2%), Cider Duties (8.0%) and the Climate Change Levy (5.5%).

These tax receipts can also be considered in the context of the recommendations from the Silk Commission’s report into fiscal powers. Based on these recommendations, we can estimate how much revenue is currently raised from taxes that have been recommended to be fully devolved to the Welsh Government. In 2012-13, £139 million was raised from Stamp Duty Land Tax, £50 million from Landfill Tax and £22 million from the Aggregates Levy. For the recommendations for devolution of parts of Income Tax and Air Passenger Duty we have not been able to estimate how much of the total revenue raised would be raised by the Welsh Government. As these statistics are still in the developmental phase, HMRC will undertake further consultation with users within one month of publication. Anybody who would like to be involved in the consultation should contact HMRC. Article by Gareth Thomas